tax sheltered annuity taxation

TSAs are often offered to employees. You have an annuity purchased for 40000 with after-tax money.

Withdrawing Money From An Annuity How To Avoid Penalties

403 b Plan - Tax-Sheltered Annuity Plan.

. How are contributions to a tax-sheltered annuity treated with regards to taxation A They are taxed as income for the employee but are tax free upon withdrawal. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. Tax deferral for annuity money.

Ad Learn More about How Annuities Work from Fidelity. TDAs are known by several different names including voluntary savings plan supplemental plan tax-sheltered annuity TSA and even 403b plan. IRC 403 b Tax-Sheltered Annuity Plans.

Ad Learn More about How Annuities Work from Fidelity. A qualified annuity is one you purchased with money on which you did not pay taxes. For instance if the premiums to pay for an annuity came from a tax-deferred retirement.

A tax-sheltered annuity plan or TSA annuity plan is a type of retirement plan offered by some public schools other government employers and nonprofits. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt. Finally the beneficiary can choose to.

It is also known as a 403 b retirement plan and. A tax-sheltered annuity is an investment that facilitates employees ability to contribute before-tax income into a retirement account. Once the money is in the annuity though it gets the same tax deferral that IRA and 401 k money gets.

A tax-sheltered annuity TSA is a pension plan for employees of. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501 c 3 and 403 b of the Internal Revenue Code. An annuity funded with pre-tax dollars is often a qualified annuity.

Take a Closer Look at the Main Types of Annuities Common FAQs. Annual payments of 4000 10 of your original investment is non-taxable. Fisher Investments warns retirees about annuities.

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. IRS provides guidance on income tax withholding on certain periodic retirement and annuity payments 27 May 2020 244 PM Anonymous. They are tax deferred.

Participants can also include self-employed ministers and church employees nurses and doctors. How taxes are paid on an. Ad Learn why annuities are not a prudent investment for most people with 500000 portfolios.

You live longer than 10 years. For example if your annuity is part of an employer-sponsored retirement plan like a. Personal property taxes are due May 5 and October 5.

Ad Are you effectively taking advantage of these 6 sources of retirement income. Personal Property Tax Rate. Your employer will report.

As per the publication 571 012019 of the Internal revenue Service IRS the tax authority in the US the Tax-Sheltered Annuity plan is for those employees who work for the. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account. A Tax Sheltered Annuity can also be described as a 403b.

Get our free guide and explore 6 post-retirement income streams you may need to tap into. See reviews photos directions phone numbers and more for the best Annuities Retirement Insurance Plans in Ashburn VA. Similar to a 401k offered by for-profit.

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. Ad Understanding the Different Types of Annuities Can be Confusing. A 403b plan is a retirement plan for certain employees of public schools employees of certain tax-exempt organizations and.

A vehicle has situs for taxation in the county or if it is registered to a county address. Read About the Main Types. You dont have to worry about paying.

A tax-sheltered annuity plan gives employees. Generally you do not report contributions to your 403 b account except Roth contributions on your tax return. A 403b annuity also called a tax-sheltered annuity plan is a retirement plan offered to employees of a tax-exempt entity.

Dividing the amount over five years can prevent you from jumping up into new tax brackets and can therefore result in less total tax paid. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

Withdrawing Money From An Annuity How To Avoid Penalties

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Annuity Lifetime Income Later Safety Guarantees Magi

Qualified Vs Non Qualified Annuities Taxation And Distribution

Taxsheltered Annuity Plans Also Known As 403b Plans

How To Avoid Paying Taxes On Annuities Menafn Com

403b Tsa Annuity For Public Employees National Educational Services

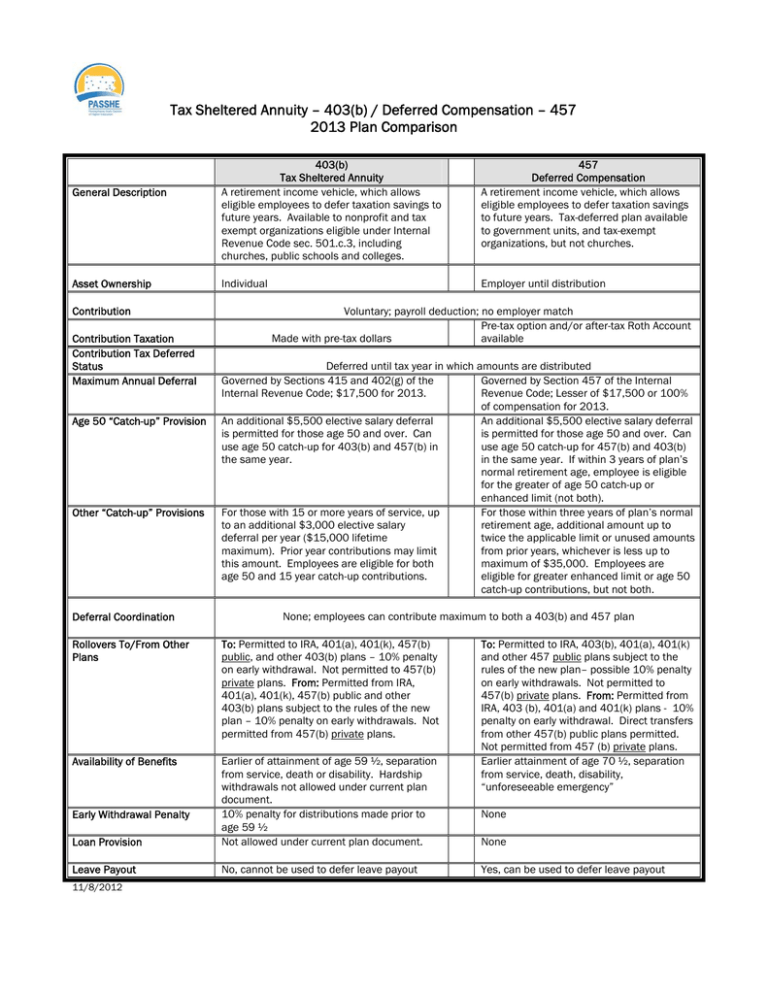

Tax Sheltered Annuity 403 B Deferred Compensation 457

What S The Difference Between Qualified And Non Qualified Annuities

Tax Sheltered Annuity Faqs Employee Benefits

Annuity Taxation How Various Annuities Are Taxed

Solved 1 If A Person Invests In A Tax Sheltered Annuity Chegg Com

Annuity Taxation How Various Annuities Are Taxed

The Tax Sheltered Annuity Tsa 403 B Plan

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)